E M Calculator Evaluation and Management, E&M Code Calc for CPT

The exact percentage allocated towards payment of the principal depends on the interest rate. Even though your monthly EMI payment won’t change, the proportion of principal and interest components will change with time. With each successive payment, you’ll pay more towards the principal and less in interest. EMI calculators offer significant benefits and are indispensable tools for effective loan management. They provide knowledge, support optimal decision-making, aid in budgeting and financial planning, and contribute to long-term financial stability. Although Loan Option 1 has a lower monthly EMI, it has a longer tenure of 5 years, resulting in a higher total interest payable over the loan period ($17,985.20).

Loan Amount and Interest Rate Relationship

Understanding the total interest payable helps you evaluate the overall cost of borrowing and assess whether the loan is financially viable in the long run. Lower total interest payable indicates a more cost-effective loan option. In the initial years, your interest proportion is higher in your https://www.intuit-payroll.org/ EMI. Your interest and principal components change every time you make your monthly installments, but your EMI remains constant throughout the loan period. Personal loans are mostly taken to serve multiple purposes like medical emergency, vacation, relocation, wedding, home renovation, etc.

What is EMI?

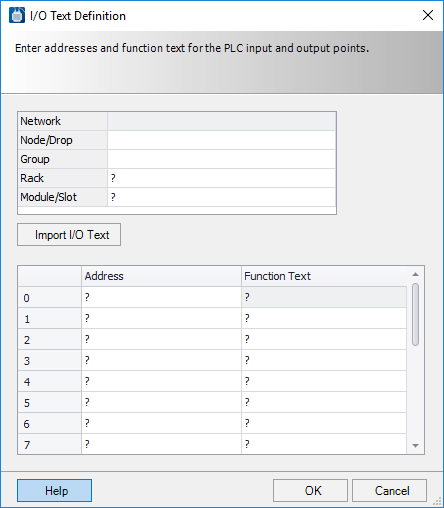

Also involved is the review of medical records and research in formulating the decision about the diagnosis and formulating the plan. Usually the more diagnoses, complex treatment, and higher the risk, the higher the reimbursement level the physician will be reimbursed. It will auto-calculate based on what is filled out as long as the var-tree selections are also coded to be in which specific level section. What the system excludes when trying to auto-calculate is free-text/dictation, but the provider can manually adjust it and mark the specifics in the E&M Calculator section levels.

Loan Amount

A loan EMI calculator allows borrowers to experiment with different loan amounts, interest rates, and tenures, helping them understand how these variables impact their monthly repayments. It empowers borrowers to make informed decisions about loan affordability and choose loan options that align with their financial capabilities. It helps borrowers avoid excessive debt or entering into loans that may strain their finances. The more areas that a physician touches/documents and examines, the more thorough and detailed the examination.

All you need to know about EMI Calculators

Affording good education in recent times has been quite a task for parents as its cost has risen at a rapid pace. To finance this cost, an education loan is one of the best options a parent can opt for. Such loans can be taken for a student’s education within the country or even overseas. The loan’s EMI is required to be repaid with interest after a moratorium period. By entering the loan amount, rate of interest, and loan tenure in the Education Loan EMI Calculator, you can calculate the sum of the EMI amount which you need to repay.

Often, a car loan’s EMI is supposed is to be repaid with due interest within a stipulated time to the lender. On failure, your car may be taken away and put up for auction to recover the balance amount left to be paid. Thus, to calculate a precise EMI amount that you can afford to pay comfortably, you can use the Car Loan EMI Calculator of Groww. You just need to enter your loan amount, interest rate, and loan tenure, and you will get the monthly EMI amount instantly.

An EMI (Equated Monthly Installment) calculator is a valuable tool that helps individuals understand the financial implications of their loans. EMI calculator is designed to give users a precise estimation of the monthly repayment amount they will need to make towards their loans. By inputting the loan amount, interest rate, and tenure into the loan calculator, users can instantly obtain the EMI amount they will be responsible for. This information is valuable regarding financial planning, budgeting, and making informed decisions about borrowing. This online tool can be used as home loan, car loan or personal loan EMI calculator. Another significant benefit of online EMI calculator is the ability to compare different loan options.

A higher interest rate increases the total interest payable over the loan tenure, and a portion of this interest is included in the monthly EMI. The EMI represents the fixed monthly payment you are required to make towards your loan. It includes both the principal amount and the interest charged by the lender. The EMI amount remains constant throughout the loan tenure unless you opt for prepayments or loan refinancing.

- Yes, The calculators used for home, car, and personal loans are similar as they work on the same EMI calculation formula.

- Collections automatically organizes your library by topics like Recent Days, Trips, and People & Pets.

- There is a specific formula that Groww uses to compute the EMI amount for a loan.

- A risk that’ll positively impact your project is an opportunity – with positive value (best-case scenario).

It is important to note that the loan term or tenure also affects the EMI calculation. While the loan amount and interest rate primarily determine the EMI amount, the tenure determines the number of monthly installments. When you make your monthly EMI payment, a portion of that payment is designated for covering the interest charges. The interest is calculated based on the loan’s outstanding balance, which is the remaining amount you owe.

Some words and phrases automatically display a suggestion, and you can also add one of the many new effects to any text. Lock an app to require Face ID, Touch ID, or your passcode for access. Information from the app won’t appear in other places across the system, including search and notifications, so others don’t inadvertently see sensitive information.

Consider the total interest amount to assess the overall cost of borrowing and determine which option is more financially favorable. Loan Option 2 has a shorter tenure of 4 years, which means you’ll pay interest for a shorter duration, resulting in a lower total interest payable ($12,230.84). Consider a practical example to compare two loan options the flow of costs in job order costing using an EMI calculator. In the context of monthly EMI payments, interest refers to the cost the lender charges for borrowing the funds. It represents the additional amount you pay on top of the principal amount. When you make your monthly EMI payment, a certain percentage of that payment is allocated towards reducing the principal amount owed.

If you have to choose between different options for a project with identified risks, use the EMV calculator to determine the EMV of each risk. Then when a provider selects that var-tree item, the https://www.business-accounting.net/what-are-the-differences-between-idle-time-and/ automatically marks it for that level and helps to calculate the code based on what is marked. The microstrip patch antenna calculator determines the length (L) and width (W) of a rectangular microstrip patchantenna for a given resonant frequency or vice versa. If theratio (L/W) is close to unity, the radiation pattern will be symmetric but may not provide a resonable input impedance. The radiation edge input impedance is also calculated and is based on W. For using EMI calculators for a loan, you just need only three variables such as Principal loan amount borrowed, interest rate, and loan tenure.

The loan amount refers to the principal sum you borrow from a lender. It represents the total value of the loan before interest and fees are added. In EMI calculations, the loan amount directly impacts the EMI amount. A larger loan requires a higher monthly repayment to cover the principal and interest. Over time, the principal component of your monthly EMI payments grows while the interest component gradually decreases.